The new Canadian Dental Care Plan is here!

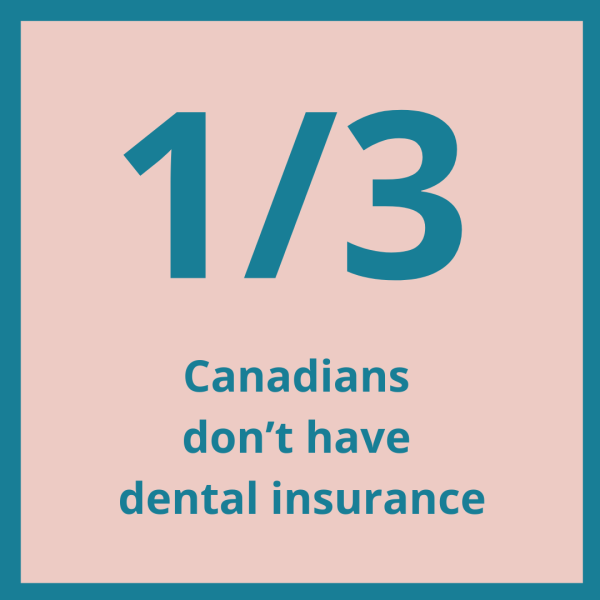

The plan aims to ease financial barriers to accessing oral health care for uninsured Canadians with an annual family income of less than $90,000.

Oral health is an important part of our overall health and well-being. Lack of access to health care can have wide-reaching impacts, such as more expensive treatments and worsening health outcomes for a variety of conditions, including chronic pain. It’s a relationship that goes both ways: poor oral health can worsen chronic pain, and chronic pain can have a detrimental impact on oral health.

Oral health is an important part of our overall health and well-being. Lack of access to health care can have wide-reaching impacts, such as more expensive treatments and worsening health outcomes for a variety of conditions, including chronic pain. It’s a relationship that goes both ways: poor oral health can worsen chronic pain, and chronic pain can have a detrimental impact on oral health.

The Canadian Dental Care Plan (CDCP) aims to ease financial barriers to accessing oral health care for uninsured Canadian residents who have an adjusted family net income below $90,000. The CDCP will help cover a wide range of oral health care services, on the recommendation of an oral health provider, when needed.

What’s covered in the plan?

The Canadian Dental Care Plan will cover a wide range of oral health care services, on the recommendation of an oral health care provider, when needed.

Services that could be covered under the CDCP include the following, with some services only becoming available in fall 2024:

- preventive services, including scaling (cleaning), polishing, sealants, and fluoride;

- diagnostic services, including examinations and x-rays;

- restorative services, including fillings;

- endodontic services, including root canal treatments;

- prosthodontic services, including complete and partial removable dentures;

- periodontal services, including deep scaling; and

- oral surgery services, including extractions.

Health Canada is collaborating with provinces and territories regarding public oral health services, including the coordination of benefits between the CDCP and provincial and territorial publicly funded programs.

How much is covered?

To limit the out-of-pocket costs, participating oral health providers will bill the Canadian Dental Plan directly for reimbursement. Some people covered under the plan may have to pay additional charges directly to the oral health provider if:

- your adjusted family net income is between $70,000 and $89,999 (see below)

- your oral health provider charges more than the established Canadian Dental Care Plan fees

- you and your oral health provider agree to services that the Canadian Dental Care Plan does not cover (you will need to pay the full cost of these services).

You may have a co-payment based on your adjusted family net income. A co-payment is the percentage of fees that isn’t covered by the Canadian Dental Care Plan, and that you will have to pay directly. Your co-payment is based on your adjusted family net income:

- No co-payments for those below $70,000.

- 40% co-payment for those between $70,000 and $79,999.

- 60% co-payment for those between $80,000 and $89,999.

Before receiving oral health care, people covered under the Canadian Dental Care Plan should always confirm what costs, if any, will not be covered by the plan. People who receive services not covered by the plan will need to pay the full cost of these services.

Who qualifies?

Who qualifies?

Canadian residents who meet the following criteria qualify for the Canadian Dental Care Plan:

- No access to any type of dental insurance, including through an employer, family member, pension, professional or student organization, or purchased by yourself or a family member.

- Family income of less than $90,000 after taxes and adjustments.

- Canadian resident for tax purposes and have filed their tax return in the previous year.

When and how can you apply?

The Canadian Dental Care Plan is being rolled out using a phased approach over several months according to the schedule below.

Group |

Applications open |

How to apply |

| Seniors: 87+ | December 2023 | When applications are open for their age group, seniors aged 70+ will receive a letter from Service Canada inviting them to call to apply via an automated Interactive Voice Response system. |

| Seniors: 77 - 86 | January 2024 | |

| Seniors: 72 - 76 | February 2024 | |

| Seniors: 70 - 71 | March 2024 | |

| Seniors: 65 - 69 | May 2024 | From May 2024 onwards, applications for all age groups will be accepted online. |

| People with a Disability Tax Credit | June 2024 | |

| Children under 18 | June 2024 | |

| All remaining eligible applicants | 2025 |